Reasons for young people quitting

A recent Time Magazine article, Bruner, R. (2021, November 8). They quit. Now what?. Time, 49-50, had several interesting examples of many young people (workers aged 20 – 34) quitting the workforce. The first individual spotlighted is seemingly living blissfully in Rome, listening to locals chat at cafes, and enjoying bowls of gelato. Her prior position, as a mental health therapist for at-risk youth, was apparently not fulfilling enough and now she dreams of being a telehealth practitioner. Another individual, aged 23, had spent five years as a hospitality worker and bartender and quit due to the work stress related to dealing with poorly mannered customers. Now she is studying and helping service workers organize for better working standards.

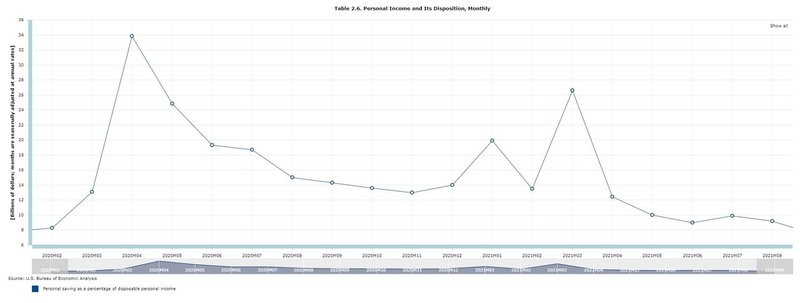

In my opinion, the above two examples do not really reflect the true reason for young people leaving the workforce as determined by the Bureau of Labor Statistics. People have always had their own personal reasons to quit work though they have tended to re-enter the workforce as their unemployment benefits or savings dried up. Relocating to a new city, the birth of a child or the need to take care of a sick parent, attending university or graduate school, are just a few typical reasons to leave the workforce. However, the unprecedented financial support by the federal, state, and local governments to individuals during the coronavirus pandemic, coupled with the reduction in leisure and recreational activities (travel, movies, live concerts, etc..) has provided a boost in savings for individuals. In fact, we can see from the table below the personal savings rate as a percentage of disposable income as per the Bureau of Economic Analysis during the coronavirus spike to over 30% and had stayed above 10%. Only now has the rate fallen to pre-pandemic rates: the latest savings rate data from September 2021 shows the rate of 7.5%, nearly identical to the pre-pandemic level of 7.8% in January 2021.

Once their savings that were accumulated during the pandemic period has dried up, those individuals who have left the labor market will surely be looking for work again. And with the increasing labor shortage that many companies are facing, the wages of those reentering workers will no doubt be a nice bump up from their pre-pandemic salary.

Real drawbacks of doing so

Let’s imagine that the traveler to Rome or the bartender-turned student/labor organizer develops a serious medical issue. Perhaps a kidney needs to be looked at, or a knee has to be operated on after tripping over the cobblestones of Rome. Having adequate health insurance is vital for all individuals, but most people in the U.S. lose their employer-sponsored health insurance. Certain government programs such as Medicaid or programs under the Affordable Care Act may be available, as well as COBRA, but only for a limited period of time and this isn’t available if the worker voluntarily quits. Leaving a job and then getting injured or suffering an illness that requires a hospital stay is overlooked in the Time article but this is just one possible drawback of leaving the workforce.

Remote work or working as a digital nomad may sound enticing to those people who do not want to be stuck in a crowded office building or dream of working remotely from a beach on a tropical island, but the reality is much different. Not everyone has the skillset or mentality to be a digital nomad and set their own schedule, let alone always be hustling for clients. For global nomads, working overseas even on a temporary basis can be difficult and the coronavirus pandemic has shown that many countries respond differently to major catastrophes. Many ex-pat workers were locked out from returning to their home country for many months. Being trapped in Fiji for several months does not sound like a hardship, but it does when you cannot visit home to see the birth of new family members or visit aging parents.

Another issue is how the reliance on using savings to support one’s current expenses, will impact funds available for retirement later in life. One of the least discussed financial topics that all adults should understand is the power of compounding. Earning money on your money is quite an amazing feat. Compounding works by increasing the amount of money initially saved, invested, or any amount gained through interest, dividends, or other cash compensation. However, compounding works best over a long period of time (an initial deposit of $5,000 with a 5% annual return will grow to just $6,381 in five years but will be nearly $21,600 in 30 years). People who drop out of the workforce and who deplete their savings are reducing the number of years their savings/investments can compound, which is the main driver of future financial well-being.

Changes that could help society

Lastly, dropping out of the workforce to receive further education in their field or to be re-trained for a role in a different industry is a productive benefit. Not working for an extended period of time to “prioritize one’s self-worth” doesn’t seem like an ideal use of time. It is common that as young people reach adulthood, they feel that their voice is unique and their difficulties are special that only they can understand. Mothers and fathers experience this with their children as they progress from the stages of adolescence to adulthood. Most children will complain to their parents that the current young generation is suffering from trauma and social influence that their parents surely do not understand. It is as if children cannot comprehend that their mother or father was a teenager and young adult at one time and who also experienced school or social stresses. Today’s young adults are going through similar issues that a generation before and a generation to come have and will experience. However, there does seem to be more aware of the impact extended quarantines are having on the mental health of people especially adolescents and young adults. This year, several well-known athletes such as tennis star Naomi Osaka and gymnast Simon Biles have faced mental health issues publicly and have helped to reduce the stigma of mental illness.

If the move away from employee status at mid-to-large sized companies is to continue then the benefits many of them provide to their workers, namely matching retirement contributions and employee-based health care, paid parental leave, need to be portable and accommodating to the new workforce. Remote workers, freelance consultants, need to have access to affordable health care and tax-advantaged savings plans. Laws governing these issues need to adapt to the changing workplace.

Maybe this type of Europeanization of America is inevitable, where economic growth is slower and the invisible hand of the market is replaced by government handouts and high taxes to pay for them. Due to its social-democratic policies, it might be comfortable to live in Europe, with its many social benefits, however, one can not say that European business, markets, or even culture are still relevant on the global scene. Of the largest fifty companies by revenue, only eight firms are European, whereas twenty-four are American. Looking at the top companies by brand value, there is no European firm in the top-twenty, and only seven firms out of the top fifty are European.

Though it is hard to imagine now, at one-time America was an emerging country. From the mid-1800s to the early 1900s, the country experienced many innovative successes that directly led to economic growth and prosperity. Inventions from the Singer sewing machine, Kodak Brownie camera, and Ford’s Model-T efficient production process. It is possible that the United States is going through the final last stages of economic growth and development before it heads to a plateau and eventually declines. People now want more work-life balance, with a bigger emphasis on a life balance and less emphasis on work. Young workers want to leave the workforce, travel, study, and or gamble in cryptocurrencies or MEME stocks. Unfortunately, these activities are going to lead to slower economic growth and a no-growth to a low-growth economy has consequences. It is much easier for a country to manage a heavy debt burden if its growth rate is strong, less so if its growth rate slows down. As debt servicing payments increase as a proportion of the national budget, fewer funds are available for defense, and non-discretionary spending. As the U.S. is considering a cradle-to-grave social welfare system, will it suffer the same stagnant economic growth and reduced innovative spirit from its workers as Europe? For the sake of the nation’s future, let’s hope not.